This quick guide to capital gains tax covers rates and allowances, along with calculating your bill and when to pay it.

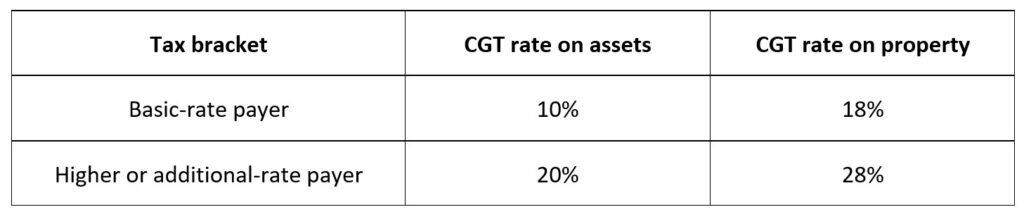

Capital gains tax rates for 2021-22 and 2020-21

There are two different rates of CGT – one for property and one for other assets. How much you pay will depend on the asset you’ve made a profit on and your tax band.

Capital gains tax rates for 2021-22 and 2020-21

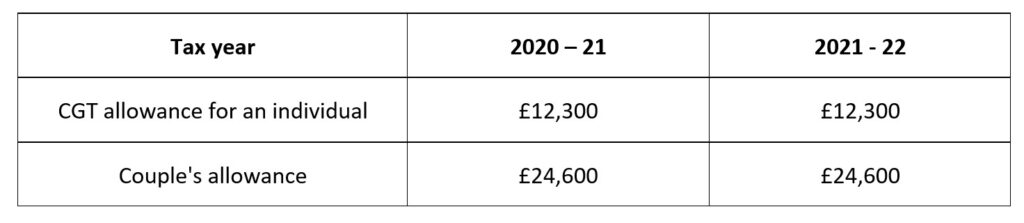

CGT allowance for 2021-22 and 2020-21

The capital gains tax allowance in 2021-22 is £12,300, the same as it was in 2020-21. This is the amount of profit you can make from an asset this tax year before any tax is payable.

If your assets are owned jointly with another person, you can use both of your allowances, which can effectively double the amount you can make before CGT is due.

If you are married or in a civil partnership, you are free to transfer assets to each other without any CGT being charged.

The table below explains your CGT allowance for the tax years 2020-21 and 2021-22.

However, if you choose to transfer any of your assets to your partner, bear in mind that if you later sell the asset, you’ll be charged based on the gain made during the period it was owned by you as a couple, rather than since the asset was passed to your partner.

If you don’t make full use of your CGT allowance in a given tax year, you aren’t allowed to carry it forward to the next.

When do you need to pay CGT?

You need to have made a certain amount of profit on your items to be taxed on them. This amount depends on whether you’re a basic-rate or higher-rate taxpayer, and what the current tax-free allowance is for the tax year.

Typical investments that you might have to pay capital gains on include:

- a second property or buy-to-let

- shares and funds, unless they’re held in an Isa or pension

- the sale of a business

- valuables such as jewellery, antiques and art

You don’t have to pay CGT if you sell a car, or if you make a profit on selling your own home.

How do you calculate your CGT bill?

If your income makes you a basic-rate (20%) taxpayer, but you have made large enough capital gain to push you into a higher-rate tax bracket, you will pay the higher rate of CGT on the amount that takes you over the threshold.

It works like this:

Step 1

Work out how much taxable income you’ve earned from your salary, pension or other types of income.

You can do this by deducting your tax-free personal allowance (£12,500 in 2020-21 and £12,570 in 2021-22) from your total income.

Step 2

Calculate your taxable capital gain by deducting the tax-free CGT allowance (£12,300 in 2020-21 and 2021-2022) from your profits.

You’ll only pay CGT on the gain you make from an asset, rather than the sale price.

That means you’re allowed to deduct the price you originally paid for it, as well as any additional costs involved with buying and selling it.

You’re also allowed to deduct the costs of improving assets, but not the costs of maintaining them (though if you rent them out, maintenance costs may be deductible against any income tax you are charged from the rental income).

Step 3

Add your taxable capital gain to your taxable income.

For a basic-rate taxpayer, the maximum taxable income you can earn is £37,500 in 2020-21 and £37,700 in 2021-22 before you start paying the higher rate.

With the tax-free personal allowance, most people can earn £50,270 before they start paying the higher rate. Note that some higher earners will start paying the higher rate earlier, as they start to lose their personal allowance if they earn more than £100,000.

And also note that if you receive the marriage allowance, this will increase the amount you can earn tax-free, but you’ll still start paying the higher rate at £50,270.

If your taxable income and your taxable capital gain added together is less than £37,700, you’ll pay basic-rate CGT (10% on most investments, 18% on second homes).

If the two figures added together put you over a higher tax threshold, you’ll pay the basic-rate (10% or 18%) on the part up to the threshold, and the higher rate (20% or 28% for second homes) on the rest.

Note that if you’re in Scotland, capital gains tax is calculated on the UK thresholds (as above), rather than on the Scottish income tax bands. That raises the possibility that you could be a higher-rate Scottish taxpayer, but still pay the basic rate on capital gains.

Deducting losses from your CGT bill

CGT is charged on your total gains each tax year. So if you make a profit when selling one item, but a loss when selling another, you can deduct the loss from the gain before working out how much tax you owe.

While you can’t carry forward any unused allowances, you are allowed to carry forward any losses that haven’t been used to offset gains.

Even if you don’t owe any CGT, it’s important to submit details of losses in your tax return to make it easier to offset them against a potential gain in future years.

When is your payment due?

You can report capital gains to HMRC via the Report Capital Gains Tax online service from the government.

Alternatively, you can file a self-assessment tax return.

If you usually fill in a tax return, you must also report any capital gains, regardless of whether you’ve already used the online service.

You also need to include how you worked out each capital gain. If you have lost money through an investment (for example, selling a second home at a loss) you should also include this on your tax return.

As of 6 April 2020, any sales of property that generate a CGT bill must be paid within 30 days by submitting a property return directly to HMRC.

Property sales before 6 April 2020 come under the old rules, where any CGT due on the sale of property is payable by 31 January after the end of the tax year in which the sale occurred, which will generally be the same date you file your tax return.

How can you cut your CGT bill?

If you’d like to minimise the amount of CGT you need to pay, you may consider the following tips.

Consider transferring assets into joint names if you’re married or in a civil partnership. By transferring an asset into joint ownership, you can both make use of your tax-free allowance so that up to £24,600 of any gain is tax-free in 2021-22.

But the transfer to your spouse or partner must be a genuine outright gift.

Investing in paintings, antiques and other collectables can be tax-efficient, especially where they are not treated as a set and so can be sold piece by piece, with each item qualifying for the £6,000 exemption.

Unmarried partners can each nominate a different property as their main home.

You can then benefit from tax relief on both.

Married couples and civil partners must choose just one, however.

If possible, live in a property before letting it out. If the property is your main home for a time period before you sell it, you can potentially reduce the CGT bill when you eventually sell it.

If you immediately sell employee shares that you get through a save-as-you-earn (SAYE) share option scheme, company share option scheme or enterprise management incentive scheme, you may have a CGT bill.

Instead, consider selling in several tranches so that each year’s gain is within your annual tax-free allowance.

If you get shares through a SAYE share option scheme or a share incentive plan, you have 90 days to transfer them tax-free to an Isa or pension. Gains when you eventually sell will then be tax-free.

This is a complicated tax system and there are certain profits that are tax-free, which I haven’t mentioned. So, it is always recommended that you talk to a good accountant.

If I can help, then please get in touch.

Let’s chat.

Susan Crichton

SJC+0 Accounts

07957 581757

susan.crichton@sjcplus0.co.uk