Recently a lot of clients have been asking me about the tax benefits of electric vehicles. Replacing your company vehicle with an electric vehicle offers several tax benefits that can not only reduce your costs but also help protect the environment.

As electric cars become ever more accessible and the Government is offering several tax advantages for low emission vehicles, their popularity continues to grow. Let’s take a look at what the tax benefits are, and what you need to be aware of when considering an electric or low emission vehicle.

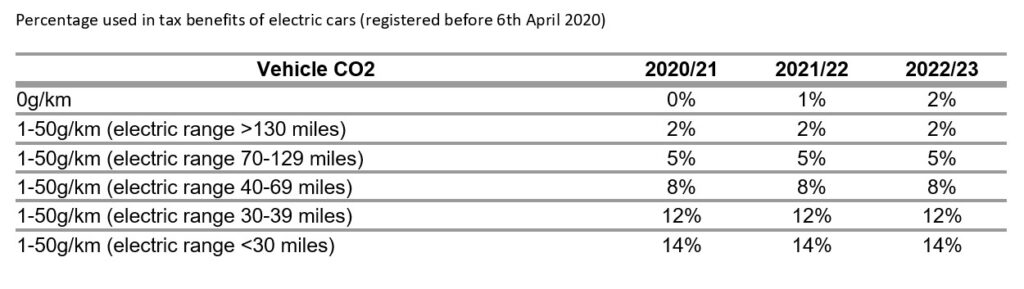

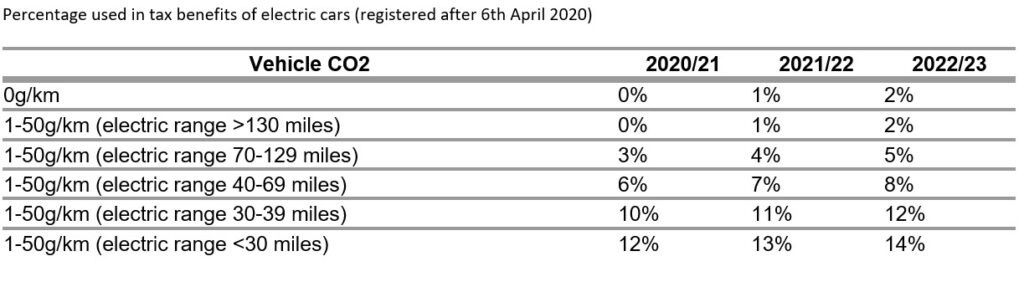

P11D/Class 1A National Insurance

The main element of the calculation applies a percentage to the list price of a company car. This percentage is determined by the CO2 emissions of the vehicle. From April 2020 electric-only cars the multiple was 0%, but this will increase in later tax years (see table below). Also, there are reductions for electric hybrids depending on their electric only range.

Electric vans

The taxable benefit for having the private use of a zero-emission van will be reduced to nil but not until April 2021.

In 2020-21 the electric van will be taxed at 80% of the benefit for a normal van, which is currently £3,490. So, the charge will be £2,792.

There is no taxable benefit at all if the van is only used for business journeys and ordinary commuting, regardless of the type of fuel.

From April 2021, a zero-emission van will be taxed at 0% of the benefit charge, therefore no benefit in kind charge for an electric van regardless of use.

Electric bikes

If you are looking at the tax position for two wheels rather than four, we need to distinguish between a bicycle with an electric motor and a motorbike. An electric bicycle must be pedal-assisted and cannot have a motor-powered top speed in excess of 15.5mph, and the electric motor must be less than 250 watts in power. Anything above this would be classed as a motorbike.

The reason we need to distinguish between the two is because they have very different tax treatments. An electric bicycle will still qualify for the Cycle to Work Scheme, so can be provided without a P11D benefit in kind arising, providing the rules are followed to comply with the scheme.

However, there are no specific tax advantages for a motorbike, and these are taxed under general use of asset rules.

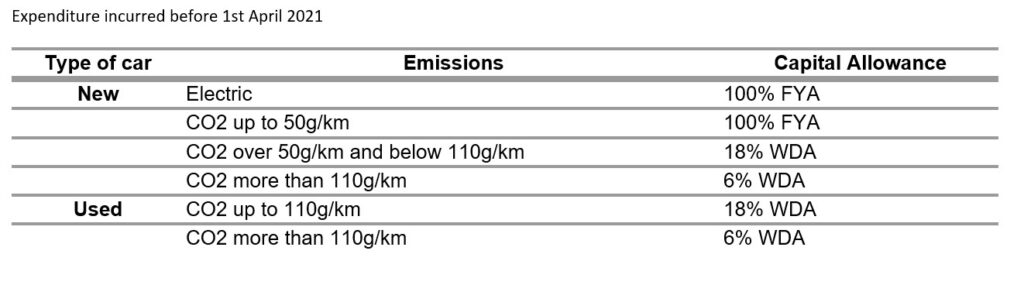

Capital allowances

For expenditure incurred before 1st April 2021, a 100% First Year Allowance (FYA) is available for a new car which is an ‘electrically-propelled’ car, or which has low CO2 emissions. An ‘electrically-propelled’ car is a car that is propelled solely by electric power (i.e. it is an All Electric Vehicle, or AEV). A car has low CO2 emissions, where the emissions do not exceed 50g/km (typically, a Plug-in Hybrid Electric Vehicle, or PHEV).

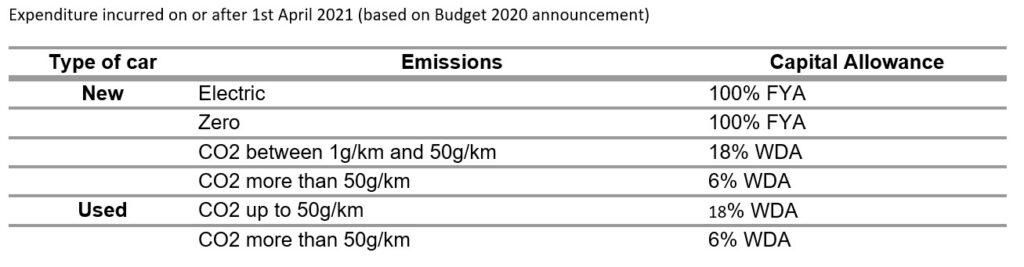

The Government announced in its 2020 Budget that, for expenditure incurred on or after 1st April 2021, the FYA will be restricted to new electrically propelled and zero emission cars.

Cars that do not qualify for a FYA are allocated to a pool by reference to an emissions threshold. The emissions threshold is currently 110g/km and it is expected to reduce to 50g/km for expenditure incurred on or after 1st April 2021. Expenditure on a car within the emissions threshold is allocated to the main rate pool (18% writing down allowance (WDA) each year) and expenditure on a car exceeding the threshold is allocated to the special rate pool (6% WDA).

The rules are summarised in the tables below:

Electric charge points and charging costs

Where the business installs, new and unused, charging points for electric vehicles up to 31st March 2023, it can claim a 100% FYA for those costs.

From 6th April 2018, where the company allows employees to charge their own electric vehicles at the workplace, there is no taxable benefit for the provision of that free electricity.

For this tax exemption to apply, the charging facilities must be provided at or near the workplace, which is the same requirement that applies to tax-free workplace parking. This tax exemption does not apply if the employer reimburses the costs of charging the employee’s own vehicle away from the workplace, such as at a motorway service station.

Where the employer pays for the cost of charging a company-provided electric vehicle there is no taxable fuel benefit for the driver, as electricity is not classified as a fuel for the car or van benefit regulations.

Where the driver of the company-owned electric vehicle pays for the electricity to power it, either from their domestic supply or by charging at a roadside station, the employer may reimburse the employee for that cost. The employer can pay the company car driver 4p per mile, to reimburse them for the cost of the electricity used for business journeys with no tax implications. This rate only applies to company-owned electric cars, not to private vehicles.

Leased cars

Firstly, just be careful here as ‘lease’ can mean different things and, depending on what they mean, it can have significant impact on the relief you will be able to get.

If you are in essence, ‘renting’ it and intend to hand it back in the future it is classed as an operating lease. This is different to Personal Contract Purchase (PCP).

This means, that if the car has emissions under 110g/km, you can get tax relief on all of the payments. From April 2021, this threshold goes down to 50g/km, so only cars with CO2 below this can you claim full relief on the rental payments.

If the car’s emissions are above 110g/km (2021/22 above 50g/km), 15% is blocked, so only 85% can be claimed for income tax or corporation tax purposes.

Can you reclaim VAT on an electric vehicle?

Under current law, an electric vehicle will still be viewed as a car for VAT purposes. Therefore, if there is any private use of the car VAT is not recoverable on purchase. The VAT can however be reclaimed if the car is used 100% for business purposes, however this can be difficult to prove to HMRC.

A similar restriction also applies to leased cars. Where there is any private use of the car then only 50% of the VAT on the leasing charge can be recovered. Full VAT recovery, subject to the usual partial exemption and business use tests, is available on ongoing maintenance of leased cars.

Vans and motorbikes are not cars so input VAT is claimable, subject to any adjustments for partial exemption and/or non-business use.

Privately owned electric cars

Where the employee uses his or her own electric car for business journeys, the company can pay the normal tax-free mileage allowance to the individual of 45p per mile for the first 10,000 miles driven in the year, with additional business miles reimbursed at 25p per mile.

Need more help?

I love working with self-employed professionals and independent business owners and if you are not receiving the service and support you deserve from your accountant then please get in touch.

Let’s Chat

Susan Crichton

SJC+0 Accounts

07957 581757

susan.crichton@sjcplus0.co.uk