How many times have you sat with your head in your hands worrying about cash flows? Lots of work, preparation, calculations, adjustments…and damn it, figures just do not add up! It’s very frustrating and creates headaches.

You might find making cash flow statements one of the most challenging issues but it’s only a statement prepared on a cash basis, in other words when you get the cash and when you spend the cash.

Maybe it sounds complicated, but with a good method and the right resources it’s quite straightforward.

Read on to find out how to prepare a cashflow, step by step.

Step 1: Prepare -Gather the Data

In order to start you need to think about and get the information for:

- Sales invoices that haven’t been paid yet

- Sales invoices that you are planning to issue over the next few months

- Your income over the coming months (if you operate on a cash sales basis)

- Any other income, including grant income and furlough wages

- Purchase invoices that you have to pay

- Invoices that you know you’ll have to pay

- Any stock you need to buy to fulfil future orders

- Wages over the coming months – this is the actual wages

- Are you planning on taking on more staff?

- Any planned training costs

- Any payments to HMRC including PAYE, VAT, Corporation tax, personal taxes

- All overhead costs including rent, rates, electricity, gas (make a note to whether these are paid monthly or quarterly), telephone, stationery etc

- All costs relating to your motor, van etc., including if are they due a service or MOT

- Review your bank statements to pick up all direct debits and standing orders which may include annual subscriptions, insurance etc

- Any costs relating to advertising and marketing planned for the next few months

- Any assets, new car, office furniture etc that you are planning on buying

- Bank interest and charges

- Loan repayments that you pay or that are due to start

Step 2: Put all this information into the Cashflow

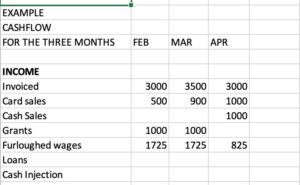

Now you have all the information, it’s time to organise it:

a) Open a blank excel sheet ready for inputting the information.

b) Start with INCOME and under each month over the next three/six months enter the actual income you expect to receive.

BE REALISTIC. If you have terms of 30 days but you know one client doesn’t pay you till 45 days then build that in to the cashflow.

If you get paid when you issue the sale but use a provider i.e. izettle, sum up etc., to collect the money remember it can take up to three days before they transfer the money to your account, so build this into the cashflow. Also factor in how quickly you get to the bank to pay in cash.

c) Now do exactly the same for EXPENDITURE. Put expenses under the month when you actually spend the cash.

- Do you take one month to pay your suppliers, or do they expect payment up front?

- When does your VAT come out of the bank?

- What date do you pay your staff?

- If you have a BBL starting in the next few months to be paid back soon make sure you include that.

- What about deferred VAT payments?

You now need to review everything and do a sense check – does it seem right or do you need to make some adjustments?

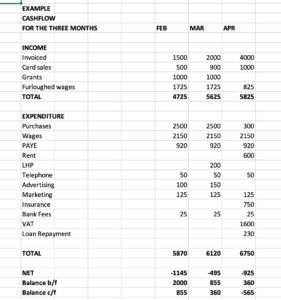

Step 3: Totals

Let’s assume that by now you have done a lot of work, made adjustments, and verified the figures. Great job. This next stage should be a piece of cake as now all you need to do is total all income and expenditure on a month-by-month basis.

On a separate line insert your NET FIGURE, which is Income minus Expenditure. The Net Figure will give you a quick idea of the months when your cashflow is going to be tight.

Lastly, you need to calculate your Opening and Closing Balances for each month. Enter the money in your bank as of today. This is your Opening Balance for this month. Add the Net Figure to your Opening Balance to get this month’s Closing Balance. This figure then becomes the opening balance for the next month:

Once this is done what do you have in front of you?

A cashflow showing you what to expect over the next few months.

If it’s all positive figures you can sit back, close your eyes and relax. If it shows negative figures you now have the tools to make some decisions – talk to the bank, talk to your suppliers, inject cash into the business.

Whatever the outcome it’s not as scary as not knowing.

A few final words

The goal of this article is to show you how to draft a cashflow and that it is doable.

However, if you find it too difficult or don’t fully understand anything then I encourage you to get in touch.

Let’s Chat

Susan Crichton

SJC+0 Accounts

07957 581757

susan.crichton@sjcplus0.co.uk